The lender recoups the loan of £8,000 and after deducing fees and interest, they send the balance to the wholesaler’s bank account.īalance transferred to wholesaler: £1,700 They remain unaware of the lender’s role. As this is confidential invoice-financing, the customer assumes they are making payment direct to the wholesaler. This is called the ‘pre-payment percentage’.Ħ0 days later, the customer pays £10,000 into a trust account controlled by the lender. The wholesaler submits a duplicate of the invoice to the lender and they send £8,000 (80%) to the wholesaler’s bank account. They will lend 80% of the value of the invoice as soon as it is raised. However, the wholesaler has an agreement with an invoice financing company. This locks up the value of the invoice for two months and slows down the wholesaler’s cashflow.

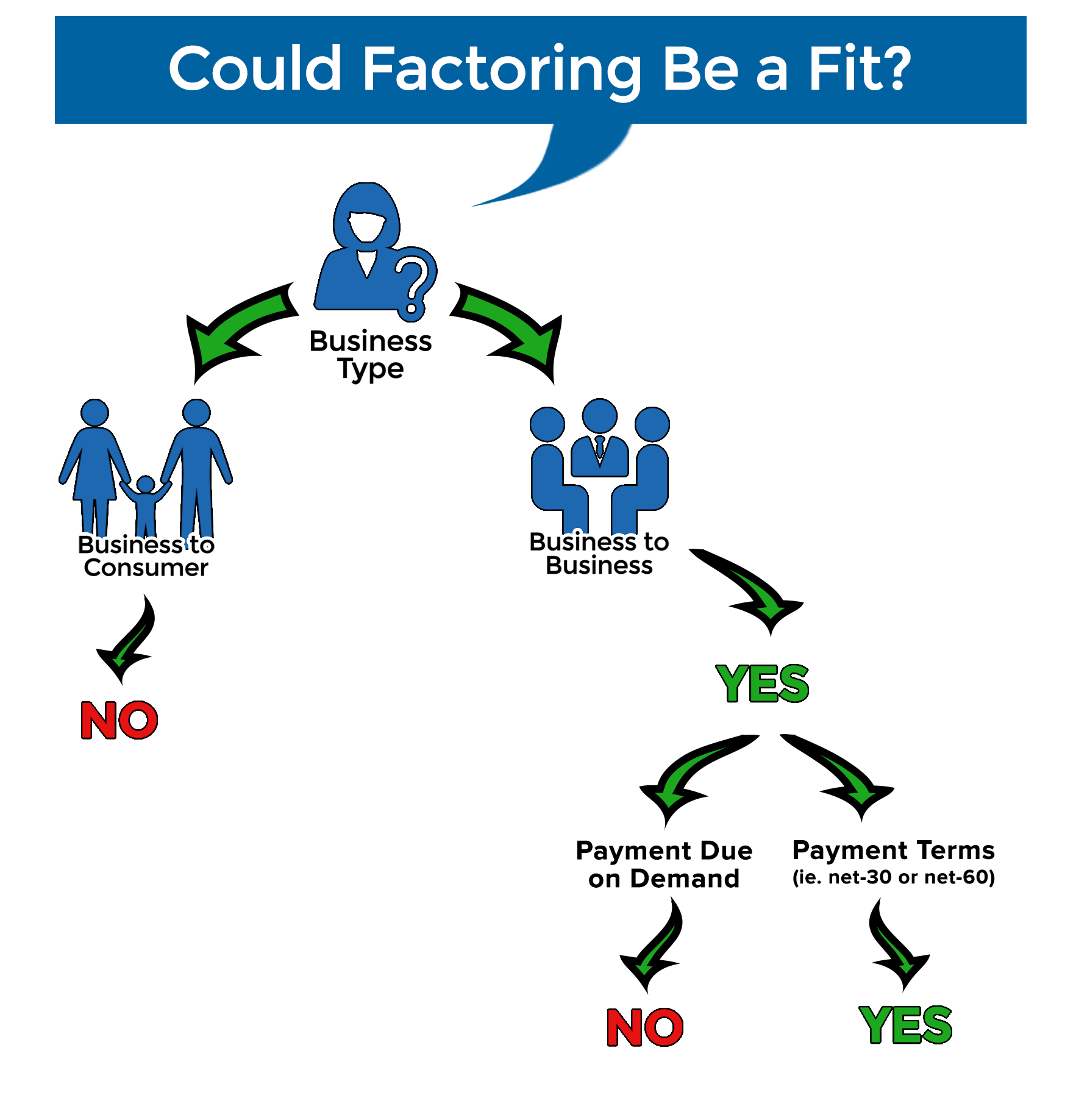

They usually take 60 days to pay the bill. With invoice factoring, the company’s customers will usually know.Ī wholesaler sends an invoice for £10,000 to a customer. The company’s customers will usually remain unaware that the company is borrowing against their invoices. With invoice factoring, the company sells their sales ledger to a third-party lender (the factor), who collects the unpaid sums. They retain control of their sales ledger and are responsible for collecting unpaid sums. With invoice financing, the company borrows against their unpaid bills. However, the main difference between the two types of finance is who collects on the unpaid invoices. These variances can affect the percentage of the sum of each invoice that is immediately provided, and the fees and interest charged. Within these sub-types, there are further differences, such as ‘selective receivables financing’. Selective invoice finance (choosing to finance specific customer accounts).Invoice factoring (or account receivables financing).Invoice financing (or invoice discounting).Invoice finance in the UK falls into two broad sub-types: However, unlike those types of lending, with invoice financing, the borrower usually has no need to provide assets as collateral, nor are the owners or directors required to supply a personal guarantee.

Invoice factoring startups series#

In simple terms, invoice financing functions in the same way as a revolving credit line or a series of short-term bank loans. Invoice financing can be used across your whole sales ledger, or you can choose the customers and the invoices you want to use for a loan (this is called selective receivables financing). In most cases, the customer will never know you used the invoice as security for a loan. Once the loan is repaid, and the lender deducts interest and fees, the balance is transferred to your bank account.

The customer assumes they are paying you, not the lender. You retain control of your sales ledger and are still responsible for chasing your customers for payment.Ĭustomers post their payments into a trust account controlled by the invoice financing company, but with the appearance of an account controlled by you. The sum received may vary from 75% to 95% of the invoice value. Payment is usually made within 48 hours of submitting your invoice. With invoice finance, the lender utilises unpaid invoices as the security for funding, giving you fast access to part of the invoice’s value.

0 kommentar(er)

0 kommentar(er)